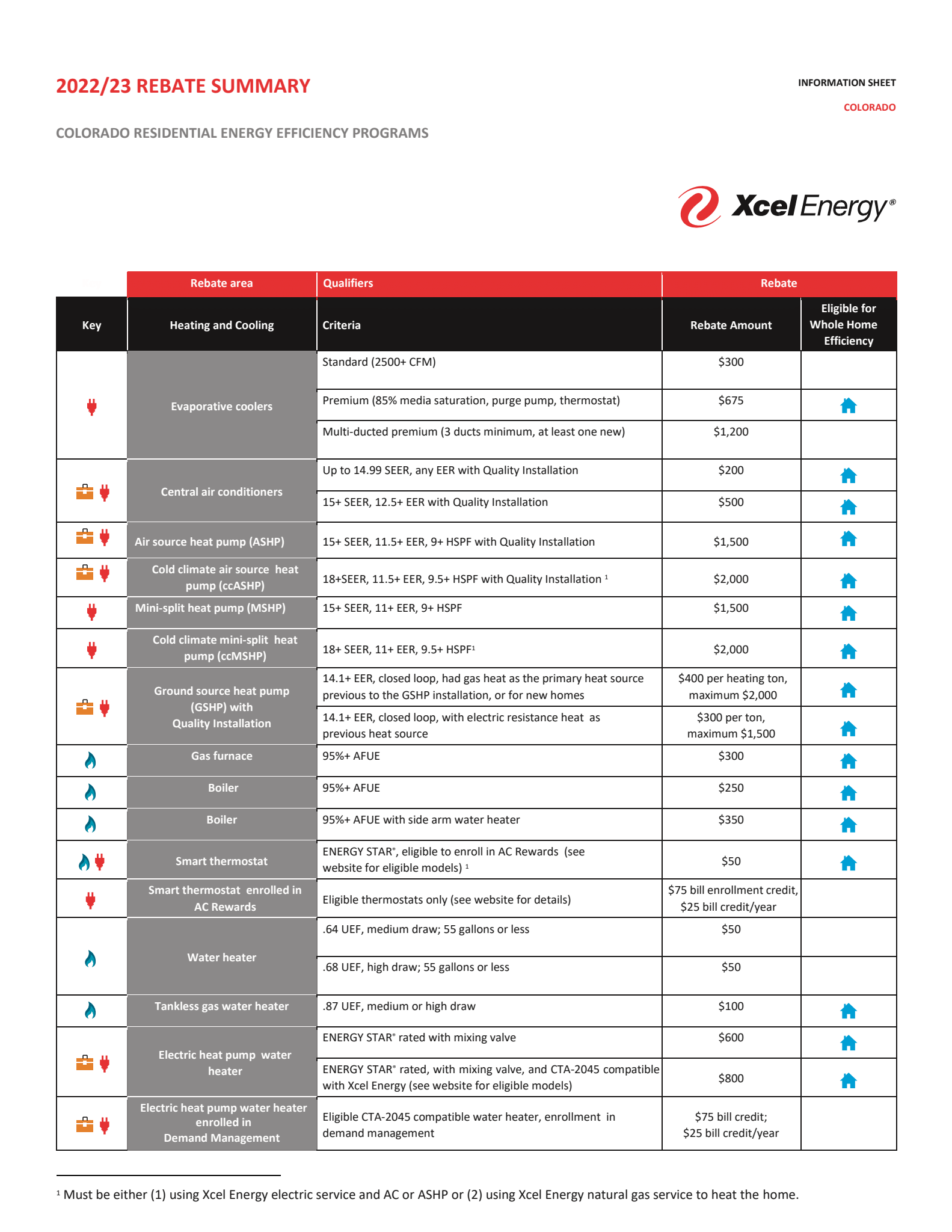

Xcel Energy Rebate Summary

Home Energy Savings Act to Extend the IRS Code Section 25C Tax Credit

The Internal Revenue Code Section 25C tax credit for qualified energy efficiency improvements has been retroactive beginning January 1, 2018 until Dec. 31, 2020. Please have your consumers consult with their tax professional for further details.

- Furnaces: Oil, propane and natural gas must meet or exceed a 95% AFUE. The maximum credit for gas furnaces is up to $150.

- Central Air Conditioners: Split system central air conditioners must have a minimum of 13 EER and 16 SEER. The tax credit is up to $300.

The best source for U.S. tax credits is EnergyStar.

Residential Tax Credits: Changes in 2023

Serving Highland Ranch, Englewood, and surrounding areas